Throughout history, money has played a crucial role in human civilization. And with the constant growth of our civilization, what we call money and how we use money have evolved.

From the trade by barter system, to the development of modern currencies, and now Cryptocurrencies, how we use money has evolved and will continue to evolve.

In this article, we will explore the key differences between fiat currency and cryptocurrencies, how crypto has the power to transform our financial systems and how you can take advantage of this change.

What is Fiat Currency?

Fiat currency is the type of currency issued and regulated by governments and central banks. It is backed by the trust and confidence of the people using it and the authority of the issuing government.

Fiat currency is widely accepted as a medium of exchange, a standard for measuring value, and a store of wealth. However, it is subject to inflation, governmental control, and centralized systems that can be vulnerable to corruption or economic instability.

Examples of fiat currencies include the US dollar, the Euro, the British Pound, the Japanese Yen, and many others used worldwide.

What is Cryptocurrency?

Cryptocurrency, on the other hand, is a digital or virtual currency that uses cryptography for security.

Unlike traditional fiat currencies, cryptocurrencies operate on decentralized networks called blockchains. These blockchains are distributed ledgers maintained by a network of computers or nodes, which verify and record transactions.

No central authority control cryptocurrencies instead they are governed by algorithms and protocols that ensure transparency, security, and the integrity of transactions.

How Will Crypto Change the Way We Use Money?

One big question that may have varying answers is how crypto will change how we use money, depending on who you ask. However, we will highlight how cryptocurrency differs from fiat currency to address this question.

1. Financial Inclusivity:

In the quest for financial inclusivity, both fiat currency and cryptocurrency play crucial roles in revolutionizing how we use money.

Traditional banking systems often present significant barriers for many individuals, particularly those residing in developing countries or underserved areas with limited access to financial services. However, cryptocurrencies bring a transformative solution, bridging the gap and offering banking services to the unbanked, the debanked, or underbanked population.

Fiat currency, issued and regulated by governments, has been the longstanding medium of exchange. However, its accessibility remains limited to those within the traditional banking framework.

On the other hand, cryptocurrencies break down these barriers by providing an inclusive financial ecosystem. By simply having a smartphone and an internet connection, anyone can participate in the crypto ecosystem and take charge of their finances, irrespective of their geographical location or socioeconomic status.

2. Cross-Border Transactions:

Regarding cross-border transactions, both fiat currency and cryptocurrency play distinct roles in reshaping the traditional financial landscape.

International money transfers often entail high costs, lengthy processing times, and reliance on multiple intermediaries. However, while fiat currency transactions continue to grapple with these challenges, cryptocurrencies offer a transformative solution.

Fiat currency, such as the US dollar or the Euro, typically involves banks or payment processors as intermediaries in cross-border transactions. This reliance on intermediaries adds additional costs, complexities, and delays in the transfer process. In contrast, cryptocurrencies enable fast and low-cost peer-to-peer transactions, eliminating the need for intermediaries.

By leveraging decentralized blockchain networks, cryptocurrencies like Bitcoin or Ethereum facilitate direct transactions between parties, making cross-border transfers more efficient and accessible.

3. Enhanced Transparency and Security:

Compared to fiat currency, cryptocurrencies offer a new level of transparency and security. Traditional financial systems can be susceptible to fraud, corruption, and identity theft. Cryptocurrencies utilize advanced cryptographic techniques to secure transactions and protect user identities.

Blockchain technology ensures transparency, as all transactions are recorded on a public ledger, making it virtually impossible to alter or manipulate transaction history. This increased security and transparency can foster trust in financial transactions and reduce the need for third-party verification.

Moreover, cryptocurrencies provide individuals with greater control over their financial assets. With traditional banking, individuals rely on financial institutions to safeguard their funds. However, these institutions can impose restrictions, freeze accounts, or even confiscate funds in certain circumstances.

With cryptocurrencies, individuals hold their private keys, which grant them sole ownership and control over their digital assets; this puts individuals in charge of their financial destiny, eliminating the need to rely on intermediaries for financial transactions.

4. Democratizing Finance:

The convergence of fiat currency and cryptocurrency has sparked a paradigm shift in the financial realm, giving birth to decentralized finance (DeFi).

This innovative concept harnesses the power of blockchain technology and smart contracts to recreate traditional financial instruments and services without intermediaries. By leveraging the strengths of fiat currency and cryptocurrency, DeFi is unlocking a world of opportunities for borrowing, lending, trading, and investing within a transparent and decentralized ecosystem.

This transformative approach has the potential to democratize finance, enabling individuals who were previously excluded from the traditional banking system to access a wide range of financial services.

Unraveling the Challenges: Fiat vs Cryptocurrency

1. Navigating Volatility Challenges:

While fiat currencies and cryptocurrencies have advantages, they also face common challenges. Volatility is a crucial concern that affects both fiat currencies and cryptocurrencies, albeit in different ways.

Fiat currencies, such as the US dollar or the Euro, can experience fluctuations in value due to various economic factors, such as inflation, interest rates, and geopolitical events. On the other hand, cryptocurrencies are known for their inherent volatility, with their values often experiencing significant fluctuations within short periods.

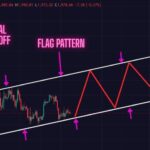

Cryptocurrency volatility arises due to market speculation, regulatory changes, and technological developments. Unlike fiat currencies that central banks and governments regulate, cryptocurrencies operate on decentralized networks and are subject to market forces and investor sentiment. News, events, or even social media trends can quickly influence the value of cryptocurrencies, leading to rapid price swings.

However, as the crypto market matures and more people adopt cryptocurrencies, the volatility is anticipated to decrease. Increased adoption and a larger market capitalization can stabilize the cryptocurrency market, as it becomes less susceptible to speculative trading and more influenced by fundamental factors such as technology advancements, utility, and real-world adoption.

2. Navigating Regulatory Challenges:

Another challenge is the regulatory environment surrounding cryptocurrencies. Governments and regulatory bodies worldwide are still grappling with classifying and regulating cryptocurrencies.

Some countries have embraced cryptocurrencies and blockchain technology, implementing favorable regulations to foster innovation and growth. However, others have imposed restrictions or outright bans, citing concerns about money laundering, terrorism financing, and consumer protection.

Finding a balance between regulation and innovation will ensure cryptocurrency’s widespread adoption and acceptance.

3. Addressing Energy Concerns:

The energy consumption associated with cryptocurrency mining has raised environmental concerns. The process of validating and adding transactions to the blockchain requires significant computational power, which in turn consumes a substantial amount of electricity.

However, ongoing research and development focus on creating more sustainable and energy-efficient mining solutions, such as transitioning to proof-of-stake consensus algorithms like the Ethereum network recently did.

How Can You Take Advantage Of This Change?

Every day, we see our financial preference ever so slowly moving towards Blockchain technology, DeFi, and cryptocurrencies. Right now, we are still at the infant stage of this industry!

Being this early to “an innovation that is having a global impact” offers you numerous benefits to learn about the industry and take advantage of the massive bull-run yet to come.

Checkout this article: A Beginners Guide to Crypto Leverage Trading

In Conclusion

As the crypto market continues to evolve, governments, regulatory bodies, and industry participants must collaborate and create a conducive environment for the widespread adoption and responsible use of cryptocurrencies.

With careful navigation of these challenges, cryptocurrencies can revolutionize how we transact, store value, and interact with the global financial system. The future of money is evolving, and cryptocurrencies are at the forefront of this transformative journey.

Checkout this article: Beginners Guide: How To Create A Balanced Crypto Portfolio For Any Kind Of Market Condition.