Bitcoin Bearish Prediction Playing Out Exactly. Sell-Off Far From Over!

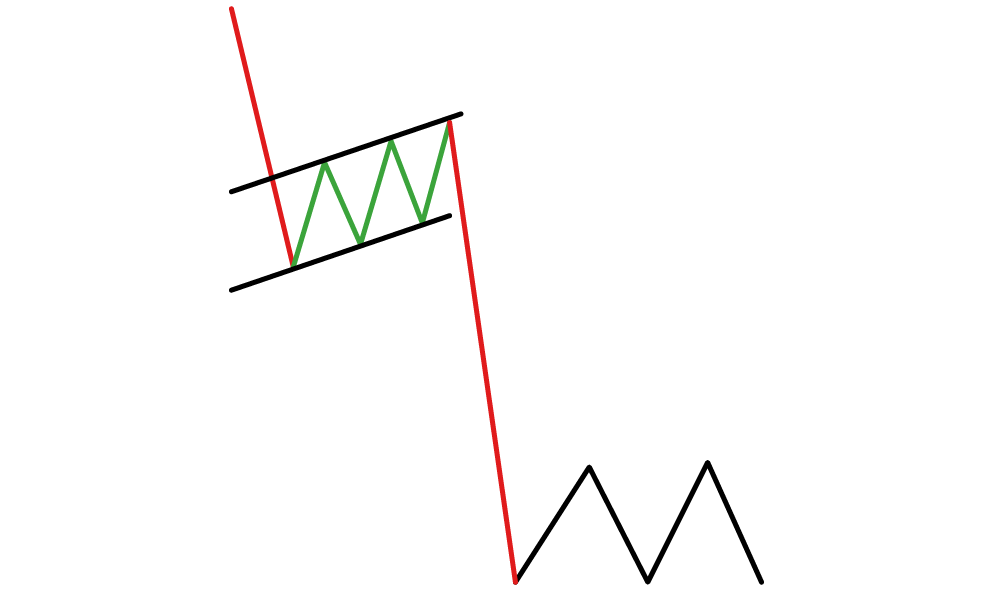

In our previous Bitcoin analysis, we talked about the BTC Bearish flag pattern currently in play on the Daily timeframe and also identified a key resistance zone the Bitcoin sellers were attempting to take advantage of last week.

Well, since publishing that TA, we have seen that bearish prediction play out as the selling pressure on Bitcoin intensified, pushing us straight down to the $86k price level over the weekend.

However, we believe this Bitcoin sell-off phase is still far from over. And in this BTC analysis, we will be updating you on our current price prediction and what we think might be setting up to happen in the coming days.

Start trading BTC,ETH, and a variety of popular cryptocurrencies with leverage as high as 100x on Bybit right now! Sign-up with our Bybit link to claim exclusive rewards of up to 6,045 USDT bonus

BTC Price Crash to $80k Next?

The key pattern we are still tracking on the BTC price chart is the bearish Flag Pattern currently playing out on the Daily timeframe. This key pattern is used to spot when a bearish trend continuation is setting up to play out.

And for Bitcoin, that bearish trend continuation could easily see the BTC price breakdown towards the $80k price level or even lower in the coming days.

If this Bearish prediction plays out, this could be a massive confirmation that the BTC bears are still in full control of the price action and we could expect to see more sellers step in and attempt to exploit this weakness in price to push us towards the $75k or even $70k price region if there are no bulls stepping up.

Final Verdict!

We are very bearish on Bitcoin and believe the BTC price sell-off is still far from over. In the coming days, we expect to see more selling pressure pour into the market as the bearish Flag Pattern currently playing out on the Daily timeframe completes its formation.

If this key bearish flag pattern plays out exactly, there is a very high probability that we see BTC crash down towards the $80k price level or even lower in the coming days.

New to the idea of leverage trading? Check out this article list:

- A Beginners Guide to Crypto Leverage Trading

- A Step-by-Step Guide on Placing your First Crypto Leverage Trade on Bybit. Introduction

- 5 Steps To Finding The Crypto Investment Style That Suits You. Beginners Guide

Bitcoin (BTC) Price Prediction For 2026: Can Bitcoin Reach $200,000?

The future of Bitcoin is getting brighter every day, and with the mass adoption going on globally, combined with the limited supply of the cryptocurrency, this could be the perfect combination that would lead to a massive surge in the value of Bitcoin in the coming years.

Is it possible for Bitcoin to get to $200,000 in value? The answer is yes! Bitcoin has already reached the $69,000 price mark previously during the 2020 bull run and the $100,000 price mark during the 2024 bull run. As far as we continue to see the global crypto mass adoption continue to grow, we can expect to see this massive rally repeat itself in the coming years.

Bitcoin (BTC) Price Prediction For 2026: Can Bitcoin Reach $1,000,000?

We have seen this $1,000,000 Bitcoin price prediction floated around the crypto industry a lot. And while it might be possible, it is not very likely to happen around 2026.

And with the rise of more innovative crypto projects, Bitcoin is in a constant battle for more funds and investments from crypto investors who are now preferring to diversify their crypto exposure among various cryptocurrencies instead of putting it all in Bitcoin.

This growing culture of crypto diversification will slow down the growth of the Bitcoin market capitalization and mean it would take much longer for the BTC price to potentially smash the $1,000,000 price mark.

Check out this article: What is Bitcoin Halving and How Will It Affect The BTC Price in 2030,2040,2050?

Bitcoin Overview: What Is Bitcoin?

Has humanity continues to evolve, the need for an electronic payment system that is globally accepted, fast, trusted, and independent from any single central government or body is becoming a necessity! And that is where Bitcoin comes in.

Founded as far back as 2009, Bitcoin was the first decentralized digital cryptocurrency that was created to solve the need for a global unbiased currency. This Bitcoin decentralized digital currency works based on cryptographic proof that makes use of the blockchain technology to facilitate trustless peer-to-peer transactions all across the world.

What does a trustless peer-to-peer transaction mean? Well, in this transaction method, computer algorithms are used to verify every transaction that is made on the network. These algorithms run on computers/hardware that can be provided by anyone from anywhere in the world who wishes to become a Blockchain miner.

These Blockchain Miners are rewarded for their computing work to verify transactions, hence creating a decentralized ecosystem that is self-sufficient without any central body controlling it.

In simple terms: Bitcoin allows two willing parties to transact directly with each other without the need for a trusted third party and these transactions are carried outside the control of any groups, or entities. (i.e banks or governments).

What Affects the Value of Bitcoin?

The First thing you need to understand is that “Bitcoin is regarded as a sort of reserve currency within the crypto market“. This means that investors will typically pile into Bitcoin when the crypto market is performing poorly. But once the the market begins to have a turn around and perform better, money will flow out of Bitcoin into more speculative crypto investments and projects.

Other factors that can influence the price of Bitcoin include things that are unique to the crypto industry (like the regulatory environment, crypto mass adoption, the rise and fall of various Altcoins and meme-coins) or macro-economic factors (like politics, inflation and interest rates).

There are a wide variety of things that all come together to determine what the supply and demand for Bitcoin will be at any point in time. And this is the same way any other market like stocks, bonds, or even forex functions.

However, what you want to keep in mind is that Bitcoin sets the trend in the crypto market. With a market capitalization of over $505,090,782,226, Bitcoin is regarded as the biggest cryptocurrency in the world, and when it moves, we can expect to see the whole crypto market react.

So by understanding how Bitcoin moves and the factors to watch out for, you can really begin to grasp how the crypto market behaves in various market conditions.

Is Bitcoin A Good Investment Right Now?

Deciding to add Bitcoin as part of your investment portfolio is all dependent on your investment goals and risk appetite. However, it is important to note that Bitcoin remains the unrivaled preference for crypto investors, even in the face of emerging innovations.

Not only that, research has proven that over 60% of the Bitcoin held by investors has remained untouched since early 2022. This is a really good news for new investors looking to step into the space because it demonstrates that investors believe in the long-term future of Bitcoin and will hold onto their investments despite the crypto market volatility.

Nevertheless, it is important we emphasize that this piece does not offer investment recommendations. As investors, it’s imperative that you carry out meticulously research before engaging in the trading of any cryptocurrency.

How Should A Newbie Approach Bitcoin Investment?

The best way for a crypto newbie to approach Bitcoin investing is by what we call Dollar Cost Averaging (DCA).

The volatile nature of Bitcoin means that we can expect to see very high swings the BTC price every now and then. Invest the bulk of your money at once at any point in time only opens you up to experiencing this price swings.

So the best way to avoid this is by investing a small part of your portfolio into Bitcoin periodically. And if you do these properly, you can expect to reap the rewards of this slow but steady investment style in the longer run as the Bitcoin price continue to rise higher in value, global adoption and business use.

Once you are more advanced, you can try out more aggressive crypto investment styles like Technical analysis and crypto trading to better optimize your portfolio.

Check out this article: 6 Popular Crypto Investment Strategies in 2023 and How To Use Them

How to Buy Bitcoin

If you are looking to take the next step and start your journey into Bitcoin investing then the next question is how to purchase your first cryptocurrency. Some of the top trusted crypto exchange includes BitFlex (allows you buy, and trade cryptocurrencies without the need to do KYC), MECX (for US Citizens), Binance (for their massive amount of available crypto projects) or Bybit

The purchasing process on each of these platforms are fairly easy and simple to replicate for any beginner.

Here are the simple steps to take:

- Choose a Trading Platform (Consider geographical restrictions, transaction fees, security, and ease of access)

- Create an Account

- Depositing Funds (you deposit your fiat currency)

- Trade Bitcoin

If you are planning to hold (hodl) your Bitcoin for a long-term (i.e making it a buy and hold investment), it is more secured to withdraw your Bitcoin and have it secured in a digital wallet or a hardware wallet.

In simple steps: you go to BitFlex (they offer you the ability to trade Bitcoin without any KYC), you deposit your Fiat and convert it to crypto, and then you withdraw your now converted crypto to your digital/hardware wallet

How Much Should I Invest in Bitcoin?

As earlier stated, this piece is not an investment advice! As an investor you need to do your own research and decide on what you are comfortable risking in this market. But the industry standard is that you only invest around 5% to 10% of your over all investment portfolio into crypto as the markets due to its high volatility.

This way you have exposure to the market while limiting how it affects your overall investment portfolio in times of aggressive sell-off in the crypto price.

If you are a longer term holder, you can overcome this bearish pressure by simply waiting it out and waiting for the Bitcoin market to bounce and begin heading back higher.

Check out this article: Beginners Guide: How To Create A Balanced Crypto Portfolio For Any Kind Of Market Condition.

Bottom Line

The crypto market is a new and exciting frontier in the world of finance, and while there are still several views of what this industry has to offer or might look like in the coming years, taking advantage of it right now puts you in the early adopters category, and opens up the potential for you to take advantage of the massive upside very likely in this industry if it continues to grow.

But before you jump in with your hard earned money, it is very important you research, study, and develop the unique techniques/skills that are required to make you a success in this industry.

FAQs On Bitcoin Price Prediction

– Can Bitcoin ever go back to zero?

While this is possible, it is very unlikely! For one reason, the mass adoption of Bitcoin across businesses, countries around the globe as made it a way stronger than a few fiat currencies still in circulation.

– What was Bitcoin’s highest price?

The highest Bitcoin price ever reached was $68,789.63 on November 10, 2021.

– Why can there only ever be 21 million Bitcoins in circulation?

Bitcoin was designed to have long term deflationary measures. This means that Bitcoin has a finite supply and even though the demand continues rise, the supply will never change from 21 million Bitcoin ever in circulation.

This is why the price of Bitcoin is so high and why a lot of crypto investors run to it as a safe haven during market turmoil’s.

– Is Bitcoin a safe long-term investment?

Bitcoin is a relatively safe long term investment especially when you compare it to other cryptocurrencies or crypto projects. However, it is important to note that this market is still very volatile and we can expect to see wild swings in the price of Bitcoin every now and then.