What is Bitcoin?

Bitcoin is a decentralized digital currency created in 2009 by an anonymous person or group using the pseudonym Satoshi Nakamoto. It became very popular as the need for a decentralized means for electronic payment systems that are globally accepted, fast, and trusted became a necessity!

Bitcoin stands out from other known traditional fiat currencies because Bitcoin operates on a relatively new network technology called Blockchain.

On this Blockchain network, every BTC transaction made is recorded across many computers, creating a decentralized, distributed and public digital ledger that cannot be altered, manipulated or hidden from other members using the network.

The use of this Blockchain technology makes Bitcoin one of the most transparent means of exchange and its popularity is rising rapidly by the day.

What is Bitcoin Halving?

Bitcoin Halving is a pre-programmed, periodic event in the Bitcoin network where the reward that miners receive for adding new transactions to the blockchain is reduced by half.

This Bitcoin Halving process occurs approximately every four years, or after every 210,000 blocks have been mined.

What is Bitcoin Mining?

Bitcoin mining is the process by which miners use powerful computers to solve complex mathematical puzzles, validate transactions, and add them to the public ledger known as the blockchain.

In return for their efforts and computational power, miners are rewarded with newly created bitcoins, along with transaction fees paid by users.

Why Does Bitcoin Halve?

There are two main reasons why Bitcoin halves:

- The first is to control the inflation rate of Bitcoin. When Bitcoin was first created, the reward for mining was 50 BTC. This reward is halved every 210,000 blocks, which is about every four years. This means that the inflation rate of Bitcoin decreases over time as fewer new coins are created.

- The second reason for halving Bitcoin is to ensure that its supply is limited. The total supply of Bitcoin is capped at 21 million coins. This means that once all 21 million coins have been mined, no more new coins will be created. This scarcity is one of the things that makes Bitcoin valuable.

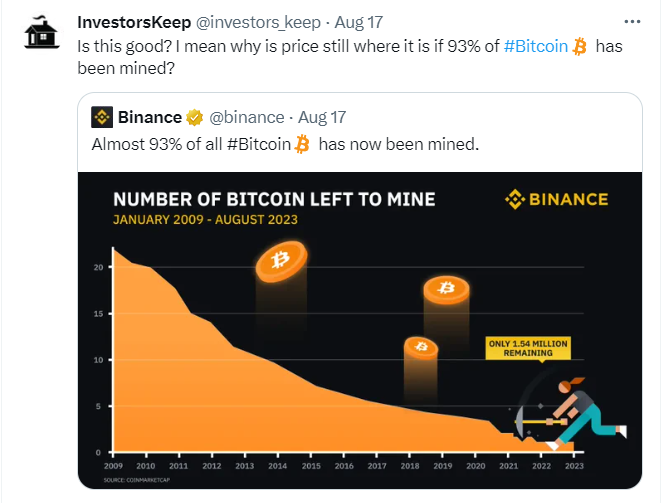

Bitcoin is gradually approaching that 21 million capped coin limit. Right now, more than 93% of all Bitcoin has been mined. Once the remaining 6% is mined, there would be no new Bitcoin addition to the network.

Advantages of Bitcoin Halving:

Bitcoin halving, despite its potential short-term effects on miners and the supply of new bitcoins, offers several advantages to the Bitcoin network and its ecosystem. Here are some of the key advantages of halving Bitcoin:

1) Supply Scarcity:

Halving events reduces the rate at which new bitcoins are created, ultimately leading to a maximum supply of 21 million coins. This scarcity is one of Bitcoin’s fundamental attributes, and it can be a compelling reason for people to hold and invest in Bitcoin as a digital store of value.

2) Price Stability:

By gradually reducing the rate of new supply, Bitcoin’s halving events aim to prevent rapid inflation of the currency. This can contribute to price stability over the long term, which is essential for Bitcoin to function as a reliable store of value.

3) Decentralization:

Bitcoin’s security model relies on miners being economically incentivized to validate transactions and secure the network. Halvings help maintain this incentive structure. As the block reward diminishes, miners must rely more on transaction fees, which encourage users to pay competitive fees, ultimately contributing to the network’s decentralization.

4) Predictability:

The four-year halving schedule is built into Bitcoin’s code, making it highly predictable. This predictability is attractive to investors and provides a level of transparency in the Bitcoin ecosystem, unlike traditional fiat currencies, which can experience sudden changes in money supply policies.

5) Long-Term Investment:

Bitcoin halving events often generate media attention and interest from investors. This can lead to increased long-term investment in Bitcoin as people recognize its value proposition and potential for price appreciation over time.

Check out this article: 6 Popular Crypto Investment Strategies in 2023 and How To Use Them

How Will Bitcoin Halving Affect the BTC Price in 2030,2040,2050?

Bitcoin halving affects BTC price by reducing the rate of new supply, reinforcing scarcity, historically influencing price trends, impacting miner economics, and shaping market sentiment.

Here is a picture showing the Bitcoin halving events that have happened so far. It also breaks down what the price of Bitcoin did in the months leading up to and after each halving:

If these market cycles continues to repeat itself during and after every Bitcoin halving, then we expect to see the factors below in the years 2030,2040,and 2050.

Supply Reduction:

One of the most direct impacts of Bitcoin’s halving is a decrease in the rate of new BTC creation. Before a halving, miners are rewarded with a certain number of newly created bitcoins (block reward) for validating and adding new transactions to the blockchain. When a halving occurs, this reward is cut in half.

For instance, after the first halving in 2012, the block reward went from 50 BTC to 25 BTC. This immediate reduction in the supply of newly minted bitcoins slows down the rate at which new BTC enters the market.

Scarcity and Increased Demand:

Bitcoin’s fixed supply cap of 21 million coins is a fundamental feature of its design. Halving events reinforce the scarcity of Bitcoin, reminding investors that there will only ever be a limited number of coins in existence.

As basic economic theory dictates; “when demand remains constant or grows while supply decreases, the price tends to rise.”

This perception of scarcity can drive up demand as investors and institutions seek to acquire or hold onto a piece of this finite digital asset.

Historical Price Trends:

Historical data supports the idea that Bitcoin prices have surged following previous halving events. An example of this is the 2012 halving, which led to notable increases in prices.

This historical precedent contributes to the expectation among investors that a halving event may result in a price increase. Consequently, more traders and investors enter the market, further driving up demand and prices.

Market Sentiment:

Investor sentiment plays a substantial role in Bitcoin’s price movements. The anticipation and media coverage of a halving event can generate positive sentiment.

Combined with the perceived scarcity and historical price trends, this sentiment can lead to a surge in demand and price.

This would lead to more investors buying into the narrative that Bitcoin is a valuable and increasingly rare digital asset.

For a more daily In-depth price analysis for Bitcoin, check out this BTC TA: Bitcoin (BTC) Price Prediction For 2023,2024,2025

When is the next Bitcoin Halving Event and What Should We Expect?

The next Bitcoin halving event is expected to occur in April 2024. This means that the reward given to miners for verifying transactions will be cut in half, from 6.25 BTC to 3.125 BTC.

The halving has historically had a significant impact on the price of Bitcoin. The first halving in 2012 was followed by a price increase of over 10,000%.

Here are some of the things that could happen in the lead-up to and after the 2024 Bitcoin halving:

- The price of Bitcoin could increase as investors anticipate the halving and the resulting scarcity of BTC.

- The hash rate, or computing power used to mine Bitcoin, could decrease as miners become less profitable.

- The difficulty of mining Bitcoin could increase, making it more difficult for miners to earn rewards.

- The demand for Bitcoin could increase as investors/businesses look to store their wealth in non-inflationary assets.

- The supply of Bitcoin could decrease as miners sell their BTC rewards to cover their costs.

Will this kind of price increase play out again in for future halvings? No one knows for sure.

It is difficult to predict what the impact of the next halving will be on the price of Bitcoin. However, many analysts believe that the next halving could lead to another significant price increase.

Check out this article: Crypto 101: What Drives the Crypto Market Price?

Conclusion On Bitcoin Halving

In conclusion, the bitcoin halving is a pivotal event within the cryptocurrency ecosystem. And this event often results in significant price fluctuations, demand and increased market attention.

While it offers several advantages such as supply scarcity, price stability, and long-term investment appeal, it is crucial for you as an investor to recognize the inherent risks and volatility associated with cryptocurrencies during these periods.

This makes it very important that anyone considering investing in Bitcoin should approach it with caution, conduct thorough research, and be aware of the dynamic nature of the cryptocurrency market.