The financial market is evolving at a rapid pace, and staying ahead of this evolution is very important to you as an investor/trader.

One of the leading factors pushing this growth in this sector is the advancement in technology (specifically AI technology).

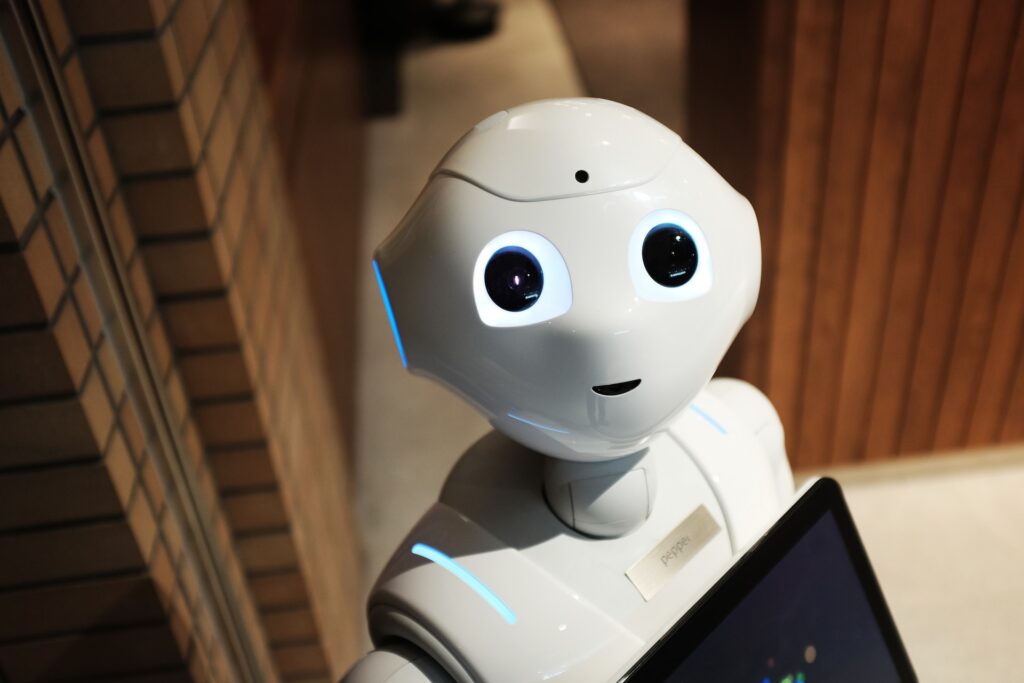

Nowadays, we see Artificial Intelligence (AI) being used in almost every field from medicine to customer care, and to even security! And with the recent buzz around Chat GPT, many investors are now waking up to the realization that “it is only a matter of time before this kind of technology finds its way to dominate the financial market”.

The question now is “How will this transition into these kinds of technology affect the Investment landscape and should you be worried?” Continue reading as we break down the good, the bad, and the ugly when it comes to AI in Finance.

Is AI The End Of Human Traders?

The first question we are going to be knocking out of the ball pack is the “Will AI end human involvement in the investing and finance industries?” question.

First and foremost, it is important to note that Artificial Intelligence in the form of Algorithms has always been used by big corporations, hedge funds, and investment banks to take advantage of small edges in the market. (It is estimated that automated algorithms execute around 60-75% of all stock trades)

However, due to the cost of researching, running, and maintaining these Algorithms, everyday investors and traders have been unable to create or make use of these very complex algorithms for their trading. But that is now changing! With the breakthrough in AI technologies, we are seeing the Finance playing field get leveled fast.

And sooner or later, every common man will have the ability to create complex algorithms that can capitalize on an edge in the Financial market. And the best part is, we will be able to do this at a fraction of the cost the hedge funds are currently paying for theirs.

Does This Mean The End Of Old Trading Methodologies?

The answer to this is No!

The Finance market is still driven by Fear and Greed! However, with the increasing complexity of the markets, AI is giving traders and investors new opportunities to gain a competitive edge. This AI will still function on the principles of time-tested methodologies, the only difference is they will be more efficient and effective in carrying out trades and managing them.

What this might look like is a combination of manual and automated trading to create a better trader/investor out of you.

Conclusion!

Automation and algorithms have been used to advantage of edges in the stock market for many years now, this trend will only increase as Ai technology evolves and becomes even more powerful.

As an average investor, you need to understand that Ai is in no way a threat to you, instead, see it as a tool that can help you improve your decision-making and level the playing field against hedge funds and big capital/smart money.