Introduction to Crypto Staking

The growing popularity of the crypto market has necessitated the rise of a crypto industry to support it. This new and growing crypto industry is constantly providing crypto enthusiast multiple avenues for making money through diverse reward-oriented activities.

Aside from buying, holding or selling of cryptocurrencies, there are other ways crypto enthusiasts can invest in the crypto market and earn gains from it. One of the more popular ways is through crypto staking.

And in this beginners guide, we will be breaking down what Crypto Staking is, how to get involved with it, the risks involved with these types of investments, and what you can expect for the future of this industry.

What Does the Term “Staking” Mean?

Staking simply means putting your resource (money) to back what you believe in. This could involve taking a stake in a company, in an enterprise, an individual, or in a Blockchain network. And in return for placing these stakes and locking up your funds for a stipulated period of time, you have your money work to earn a reward over time for you.

Most times, staking is confused to be lending, though they are similar in that both involve locking of funds, or giving out of funds to a system to use and earn interest over a certain period of time, but the major difference is “Crypto staking is mostly used to validate transaction on the blockchain network”.

What is Crypto Staking?

Crypto staking is an investment package in the crypto space that yield gains to holders of crypto assets. These holders volunteer “take part in validating transactions on the blockchain“. This means they are pledging their funds for the stability of the blockchain network on which the stake is executed.

An investor holding a certain amount of cryptocurrency may decide to lock the funds for a period of time. During this time, the funds will be used for the development of the cryptocurrency network, reward will be given to investors based on the amount of money staked into the pool.

Investors earn passive income by putting their crypto asset to work to yield gain. Each transaction carried out on the blockchain during staking is treated as a block and added to the record. This record becomes accepted when an individual is ready to provide stability and transparency by locking their cryptocurrency to the blockchain.

Consensus Mechanism: What Blockchains Accepts Crypto Staking?

A consensus mechanisms are set of rules that governs the validation process of transactions in a blockchain network. These mechanisms allow participants to interact with the blockchain, participate in the validation process by providing their cryptocurrency to help the security and stability of the network.

Many cryptocurrency networks allow users to participate directly in the system without the need of external services. Validators can stake directly from their wallet and earn their reward in the form of coin/token staked.

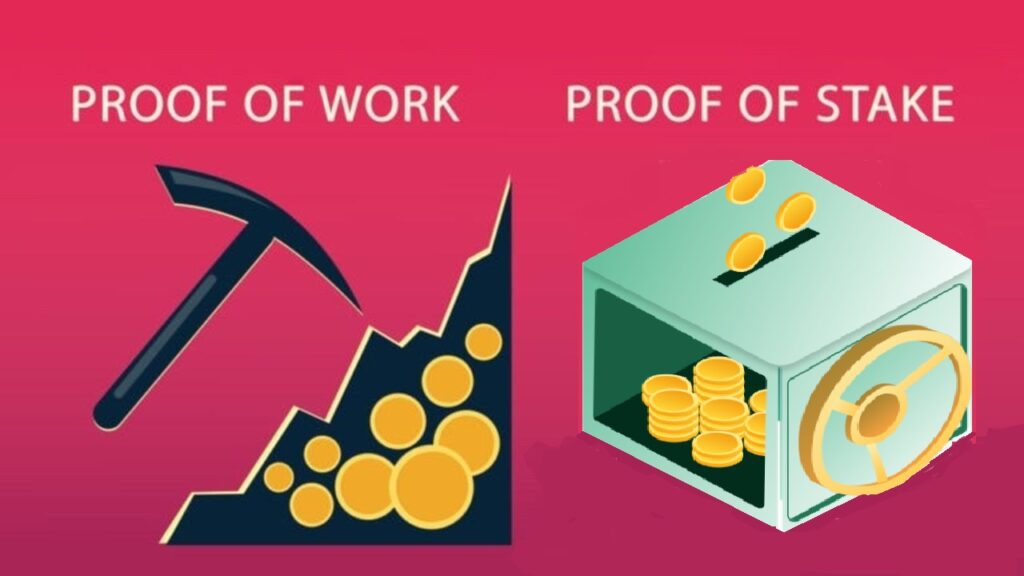

There are 2 types of Consensus Mechanism accepted for Crypto Staking:

- Proff-of-work mechanism

- Proof-of-stake mechanism

1) Proof-of-work mechanism:

PoW system is energy-consuming process of securing a network. It involves the use of computer and other mining tools to solve mathematical problems.

Each problem solved add a new block to the chain, a reward will be given for the work done. This process is usually carried out by miners and it is the method used by early crypto miners of Bitcoin.

2) Proof-of-stake mechanism:

PoS is the easiest way to validate transaction for securing a network without the need of sophisticated machine or computer power. It allows users to pledge their cryptocurrencies to provide security to the network.

Participants earn their staking rewards which can be staked for a period of time or claimed as they earn them. The more asset a validator stake, the higher the chances of been selected to add the next block in the record.

Proof of stake provide high efficiency in validating transactions. Staking rewards are provided by the network as incentives to the validators for the work done without expending energy.

How Does Crypto Staking Work?

In the traditional banking system, banks give interest to customers monthly, quarterly, or annually depending on the amount of money the individual has in the savings account. Staking in cryptocurrency is similar to this in that rewards are earned based on the amount of money users put into pledge for the support of the network ecosystem.

Crypto staking only works with cryptocurrencies that make use of proof-of-stake model in validating transactions. Rewards for staking varies among blockchain network but the similarities among them is that the more you stake, the more the reward.

When a user stake crypto asset, the user is contributing to the proof-of-stake system that keeps the network running and secure. The individual is then a “validator” on the blockchain network. The validator is selected by the system to verify and validate transactions.

One major advantage of this proof of stake system is that the more the crypto staked, the greater the potential earnings. Examples of crypto network that run proof of stake are Ethereum, Solana, Polkadot and Cardano.

Returns on Crypto Staking

Crypto staking is a form of investment. Return on investment (ROI) is given to investors at the end of the staking period.

Staking provides a passive income to investors. The reward received is dependent on the type of cryptocurrencies because different cryptocurrencies provide different block rewards. Hence, large staking pool provide more consistent payouts to validators on the network.

Benefits of Crypto Staking

Crypto staking is an income generating process. It is a profitable way to invest money whereby investors stake their cryptocurrency that has proof of stake model in order to earn reward. Investors get return from their investment over a period of time they locked their funds.

Below are other benefits of staking crypto assets

- Ease of operation: It is an easy way to earn income on crypto assets without the need for sophisticated tools or resources.

- Maintenance of blockchain security: It is an efficient way of providing security to the blockchain.

- Environmental friendliness: Crypto staking is more eco-friendly compare to crypto mining.

- High return on investment: Staking yields investors high ROI compare to just holding the crypto in their wallets, though it comes with some risks.

- Low cost of operation: Staking provides rewards to users at a low cost compare to mining. Staking does not require the use of computer power or sophisticated tools.

- Passive income generation: Staking is a passive means of making money without having to do much work.

Risk Involved in Staking Crypto Assets

Due to the nature of cryptocurrency, there are many technological risks associated with buying and staking cryptocurrency. The risk of market volatility poses a huge threat to the success of many cryptocurrency projects.

Below are some of the risks involved in staking crypto assets.

- Volatility: Crypto market is usually volatile, price fluctuates frequency. If the price of an assets staked drops, it will affects the reward the investor will earn since the investor will earn coins/ tokens as reward.

- Loss of control: During the staking period, an investor won’t be able to access the staked assets until the locking period is completed. One can only unstake an assets after a certain stipulated time.

- Slashing: Whenever a validator sends invalid transactions, the network may penalize the validator for this improper behavior. Slashing helps to provide check on the network.

In the view of the above points, before staking a crypto assets, it is important to consider the duration of the staking period, the reward rate offered by the network and the general market status of Bitcoin and other major cryptocurrencies.

For example, some crypto projects offer high rates to attract investors, but eventually their prices then end up crashing. Therefore, staking in less volatile network or more stable cryptocurrency will be a good option.

Checkout this article: What is Slashing in Crypto Staking and The Best Ways To Avoid It

Basic steps to Getting Started on Your Crypto Staking Journey

Staking cryptocurrency is a task that involves some technicality since investor is dealing with money and want to make more money in form of reward for work done on the blockchain network. Below are the simplified steps for staking a crypto asset on a blockchain network.

1) Purchase a Cryptocurrency that Operates with a Proof of Stake Model:

A crypto investor needs to carefully choose the type of cryptocurrencies to buy for staking since not all cryptocurrencies provide staking offer.

Some of the cryptocurrencies that validates transactions using proof of stake model are Ethereum, Cardano, Polkadot, Solana etc. These cryptocurrencies can be purchased from exchanges like Bybit, Binance or Bitflex.

2) Transfer the Cryptocurrency to a Blockchain Wallet:

Cryptocurrencies are best saved in blockchain wallet. There are many types of crypto wallet which are hardware and software wallets. Some cryptocurrencies have their wallets with unique features. After purchasing crypto to be used for staking, the funds will be available for use on the exchange website.

Some crypto exchanges have platforms inbuilt for staking different cryptocurrencies after purchase. If you do not like the crypto exchange staking platform, you can always transfer your crypto assets to another wallet and then connect it to a staking program of your choice.

3) Join a Crypto Staking Pool:

Staking pool provide an avenue for crypto investors to increase their earnings by massing their funds to ensure safety and smooth running of the network (staking program). When researching on the staking pools available for the cryptocurrency you purchased, it is important to consider some key factors before deciding to join;

- Reliability of the pool: It is important for a crypto investor to be sure of the uptime of the pool servers.

- Staking fees: A staking pool with a reasonable fee is better than those with high fee charge. However, different crypto programs charge varying fee. It ranges from 2%-5%. Above 5% is overpriced.

- Size of the staking pool: Staking pool can be small, mid-size or large. Small pool sometimes don’t get selected to validate transaction. Large pool will validate more transactions but rewards will be shared among many investors and can get oversaturated at times. The best among all is the mid-size pools.

After identifying the staking pool to use, transfer crypto funds from the wallet to the staking pool and start earning.

Conclusion

Crypto staking is a way of earning passive income by putting your cryptocurrencies to work. It comes with its own set of risk making it very important for you as an investor to do your own research before deciding to participate.

As an investor you need to carefully choose the type of crypto asset to buy for staking. Since different cryptocurrencies have different staking programs, you need to research on the reliability of the staking pool’s server, staking fee, and the size of the staking pool are about to invest in.

As a beginner to crypto staking, focusing on the big and Mid-size staking pool is the best step for you.

Still undecided on what cryptocurrencies to consider for staking? Check out this article: The 5 Types Of Cryptocurrencies We Have and How To Understand Their Utilities.