Introduction

Cryptocurrency trading with leverage has gained popularity among traders who aim to maximize their profits. However, this strategy is extremely high-risk and can either result in significant earnings or substantial losses.

Therefore, it is crucial to have a complete understanding of the process and the platform being used before engaging in such trading. It is important to conduct thorough research, assess the risks involved, and consider one’s financial goals before deciding to trade with leverage.

In this Beginners guide, we will be taking you through the step-by-step process for opening, funding, and placing your first crypto leverage trade on Bitflex.

Getting Started with Bitflex:

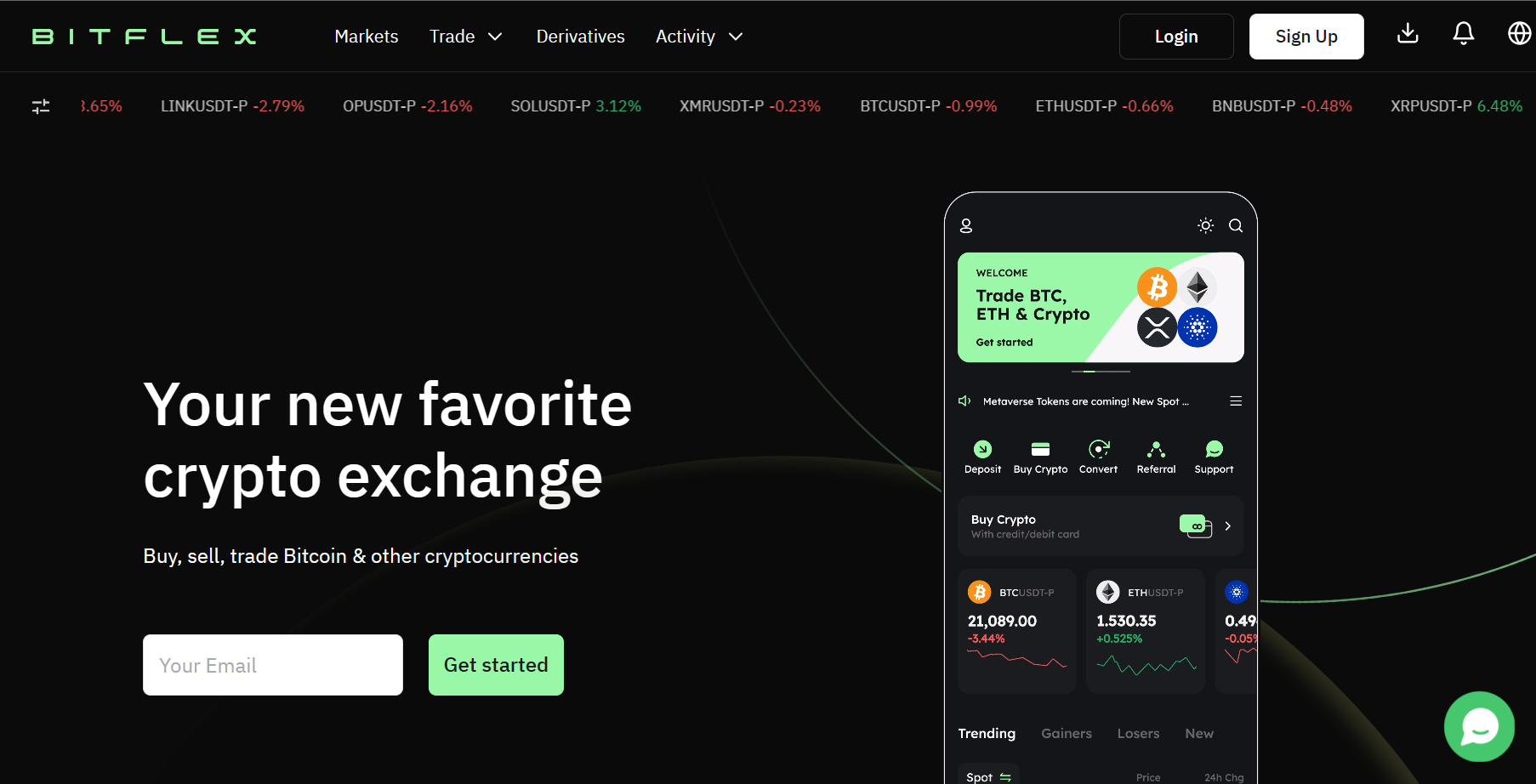

1) What is BitFlex?

BitFlex stands out as an innovative cryptocurrency trading platform, enabling users to purchase, sell, and exchange Bitcoin and various other cryptocurrencies. The platform prioritizes user safety, boasting a robust security system and adhering to the highest legal standards for compliance. Furthermore, it provides round-the-clock support and a user-friendly trading app compatible with both iOS and Android platforms.

This guide covers everything from creating a secure account to managing risk and closing your trades. Whether you are a novice or an experienced trader looking to explore leverage trading, this guide provides the knowledge and tools to get started safely and confidently.

2) How to Create an Account

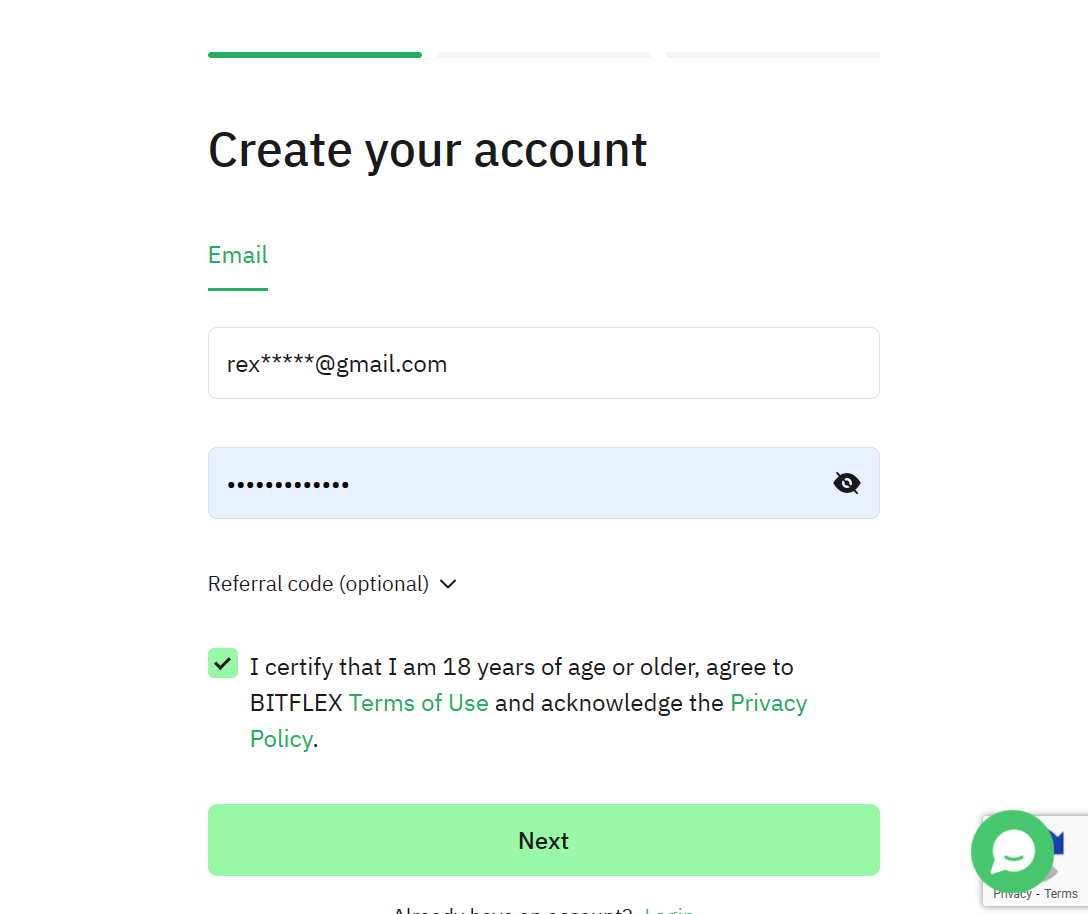

Before you can start using Bitflex, you must first register for an account. However, this is not just a simple process of entering your email and password. It is essential to ensure the safety of your assets.

To create your Bitflex account, follow these steps:

If you don’t have an account, please proceed to the signup page. For existing users, you can skip this step and directly log in.

Important Note:

- Please ensure that the email address you provide is accessible to you. Bitflex will necessitate email address verification to confirm ownership.

- Create a Secure Password: Your password must consist of a distinctive blend of letters, numbers, and special characters. Avoid using easily guessable phrases or common words for enhanced security.

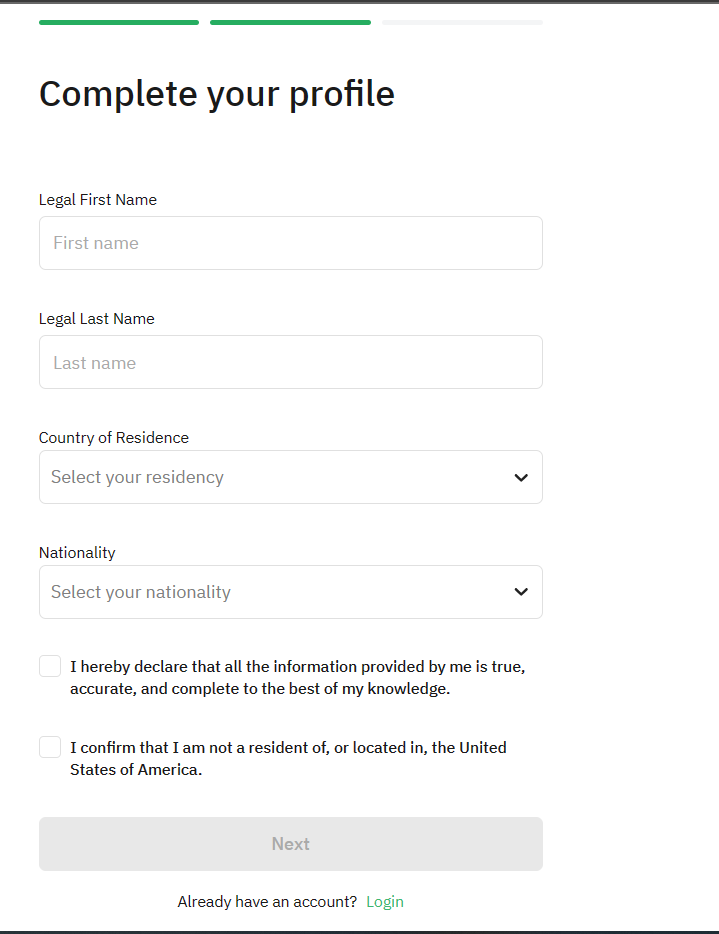

To complete your BitFlex profile swiftly and accurately, follow these steps:

- Legal First Name: Enter your complete legal first name. Make sure it matches the name on your official documents.

- Email Address: Provide an active and accessible email address. This email will be used for important notifications and updates.

- Legal Last Name: Input your full legal last name accurately. Avoid any spelling errors or typos.

- Country of Residence: Select your current country from the dropdown menu. This information ensures compliance with legal requirements.

- Nationality: Choose your nationality from the options provided. Select the country you are officially recognized as a citizen.

- Declaration: Read the declaration statement carefully and confirm that all the information provided is accurate, true, and complete to the best of your knowledge. Honesty is crucial at this stage.

- Non-US Confirmation: Verify that you are not a resident of, or located in, the United States of America. This confirmation aligns with regulatory standards and platform policies.

Completing these details ensures a seamless experience on BitFlex, allowing you to engage in cryptocurrency trading confidently and securely.

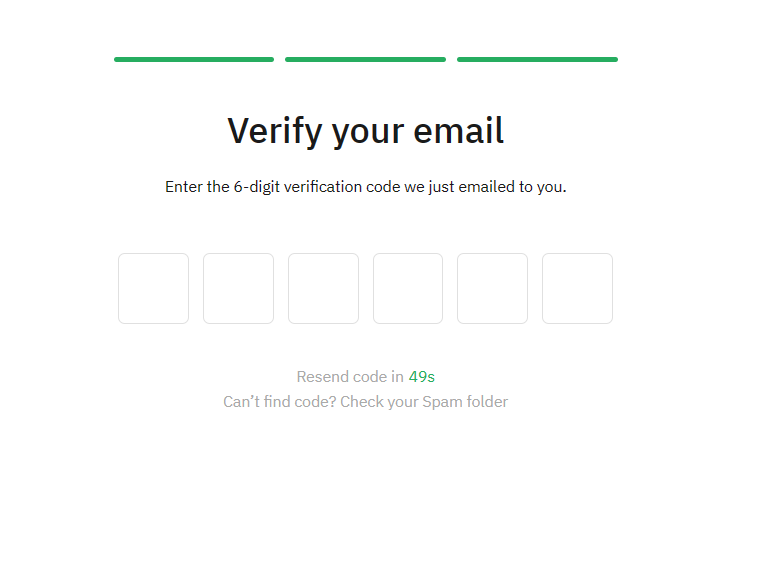

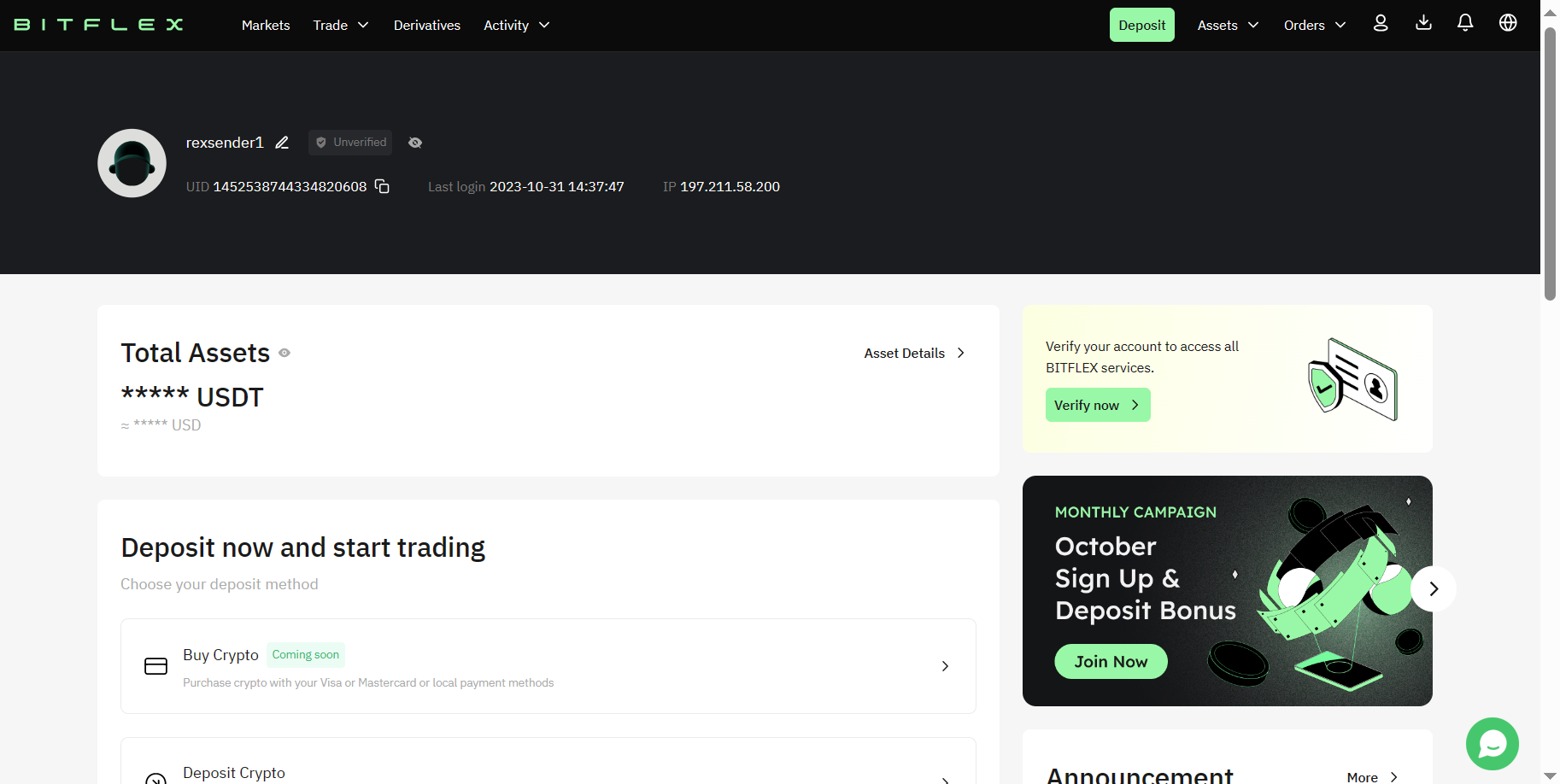

Upon entering the correct code, you will be redirected to your dashboard, confirming the successful opening of your account.

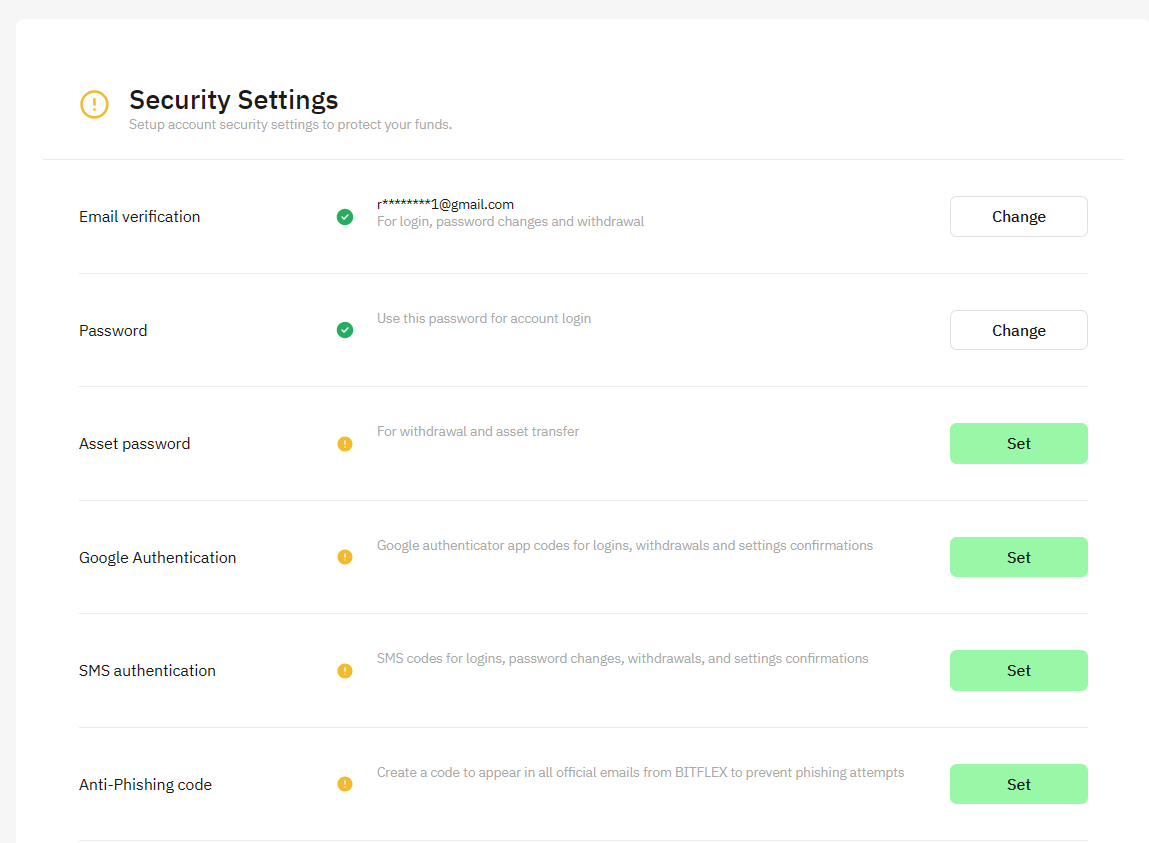

3) Securing and Verifying Your Account

Two-factor authentication (2FA): enhances the security of your account significantly. It is recommended to activate 2FA to add an extra layer of protection. You can easily set it up by using a mobile app like Google Authenticator.

Identity Verification (KYC): At Bitflex, ensuring the security of users is one of their top priorities, which is why the (KYC) regulation is very important. To initiate this process, log into your Bitflex account and navigate to the Account section. Bitflex will then guide you through the required steps for KYC compliance, which involve submitting identification documents like a government-issued ID or passport.

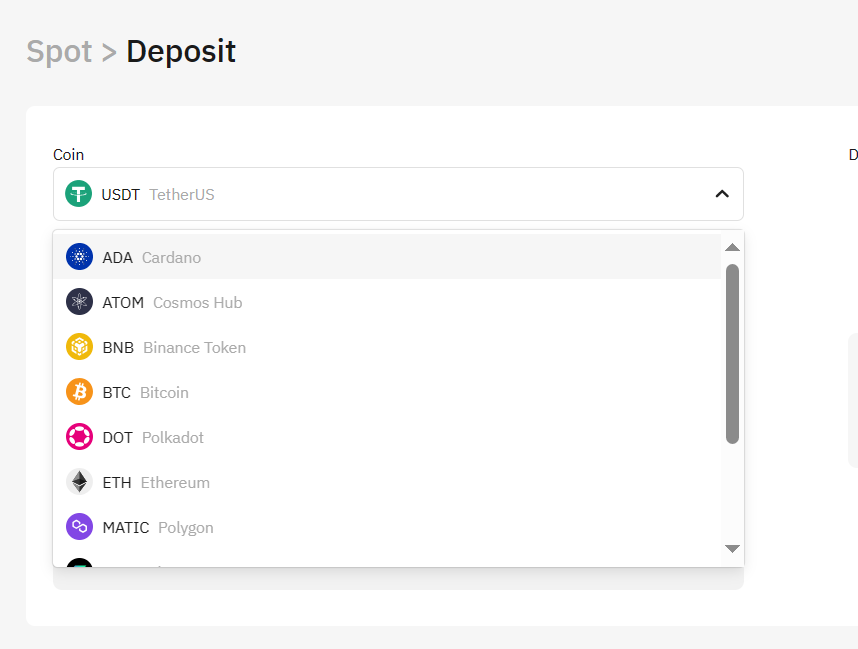

4) Depositing Funds

Once you have set up and verified your account, you will need to add funds to it. Here’s how to go about it:

- Access the Wallet section by logging in and clicking on the Assets section. Select your preferred deposit method.

Bitflex supports various cryptocurrencies.

To make a deposit:

- Choose the Cryptocurrency: Select the cryptocurrency you want to deposit.

- Generate a Deposit Address: Bitflex will provide a deposit address. Ensure you send your chosen cryptocurrency to this address from your wallet.

Understanding Leverage

What is leverage?

Leverage entails using borrowed funds to trade financial assets like cryptocurrencies, increasing your ability to buy or sell beyond your available capital. This means operating with a larger capital size than what you have in your wallet.

Depending on the particular crypto exchange, you might have the opportunity to borrow up to 100 times your account balance.

Optimal Leverage Selection

When choosing the right leverage level on BitFlex, there are several factors to consider. Here are some of the most important ones:

- Risk tolerance: Leverage increases both profits and losses, so it’s important to have a clear understanding of your risk tolerance before trading with leverage. If you’re new to trading, it’s generally recommended to start with lower leverage levels and gradually increase them as you gain more experience.

- Market volatility: Cryptocurrency markets can be highly volatile, and sudden price movements can result in significant losses if you’re over-leveraged. It’s important to monitor market conditions and adjust your leverage levels accordingly.

- Trading strategy: Different trading strategies may require different leverage levels. For example, a scalping strategy that involves making many small trades over a short period may require higher leverage levels than a swing trading strategy that involves holding positions for longer periods.

- Available capital: The amount of capital you have available to trade with can also impact your leverage decisions. Generally, it’s recommended to avoid over-leveraging and to only use a portion of your available capital for leveraged trades.

For beginners, starting with lower leverage levels, such as 1x to 5x, is recommended to mitigate risk.

Placing Your First Leverage Trade:

Bitflex does not offer Demo trading account, so as a beginner to the platform you would have to take the leap and fund a trading account in order to place trades on the platform.

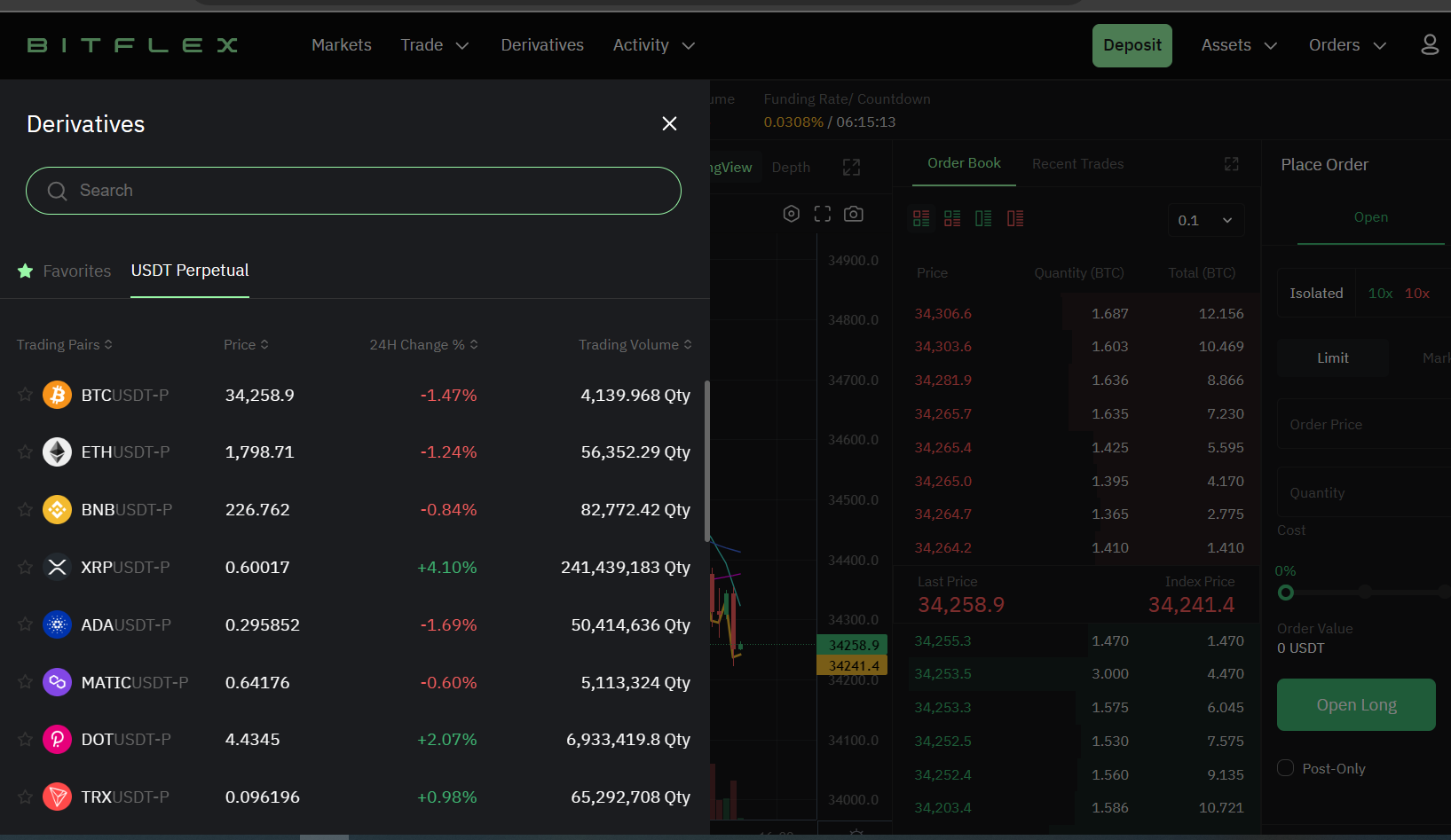

- Navigating to the Trading Interface:

You can do this by selecting the “Derivatives” menu option. This will redirect you to the Bitflex crypto trading interface.

- Selecting a Trading Pair:

Choosing the right trading pair is crucial. It represents the assets being traded. For example, MATIC/USDT means Matic against the US dollar. It is vital to select a pair that one is familiar with or has extensively researched.

- Setting Up the Trade:

It is important to understand the difference between a market order, a conditional, and a limit order. A market order is executed at the current market price, while a limit order is executed when the price reaches a specific level.

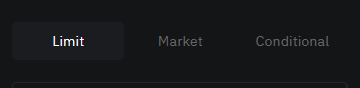

Understanding Order Types Available on Bitflex

To break it down into simple terms, we would use XRP/USDT to illustrate market, limit, and conditional orders:

- Market Order:

Definition: A market order is an instruction to buy or sell an asset immediately at the best available current price in the market.

Example: If the current price of XRP/USDT is $1500 and you place a market buy order for 10 XRP, you will buy 10 XRP at the best available price, which might be $1500 or a little higher if there is limited liquidity.

- Limit Order:

Definition: A limit order allows you to set a specific price at which you want to buy or sell an asset. Your order will be executed only if the market price reaches or is better than your specified price.

Example: If the current price of XRP/USDT is $1.50 and you place a limit buy order for 10 XRP at $1.45, your order will only execute if the price drops to $1.45 or lower. Similarly, if you place a limit sell order for 10 XRP at $1.55, your order will only execute if the price rises to $1.55 or higher.

- Conditional Order:

Definition: A conditional order is an order that will be executed automatically when certain conditions are met. These conditions can be based on the price of the asset or other market indicators.

Example: You can set a conditional order that says, “If the price of XRP/USDT reaches $1.60, then sell 20 XRP.” This order will only be executed if the market price of XRP/USDT reaches or exceeds $1.60.

Comparison of Market, Limit, and Conditional Orders

| Order Type | Features | Benefits | Risks |

|---|---|---|---|

| Market Order | Filled at the best available price | Simple to place | The order may be filled at a different price than expected, especially if the market is volatile |

| Limit Order | Filled at a specific price or better | Reduces the risk of market orders | Order may not be filled if the market price does not reach the specified price |

| Conditional Order | Only placed once a certain condition is met | Automates trading strategies and reduces the risk of human error | The order may not be filled if the condition is not met |

Which Order Type to Use?

The best order type to use depends on your trading style and risk tolerance. If you are a beginner trader, it is generally recommended that you start with limit orders. This will help you to reduce the risk of market orders. As you become more experienced, you can experiment with other order types, such as conditional orders.

In summary:

- Market orders are for immediate buying or selling at the current market price.

- Limit orders allow you to set a specific price for buying or selling, and the order will execute only if the market reaches that price.

- Conditional orders are triggered by specific conditions you set, and they automatically execute when those conditions are met.

Remember, the examples given are purely for illustration and aren’t based on real market conditions. It highlights the importance of thorough research and analysis due to the ever-changing nature of the market.

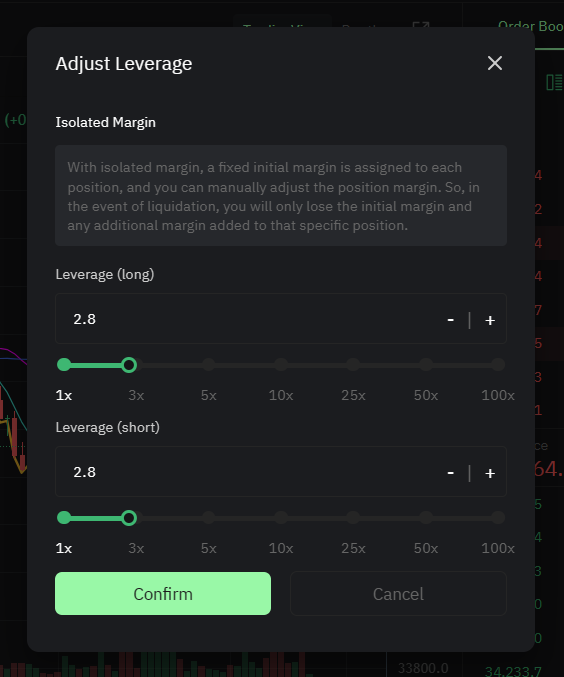

Setting Leverage

Isolated leverage is a type of margin trading that allows you to limit your losses to a specific amount. This is done by isolating the margin that is used for each position. This means that if one position is liquidated, the other positions will not be affected.

Example of How to Use Isolated Leverage

If you believe that the price of XRP is going to rise sharply shortly and want to take a speculative position on XRP, but you do not want to risk losing more than 10% of your account balance.

You deposit 1000 USDT into your account. You then place a trade to buy 100 XRP at 10x leverage. This means that you are borrowing 900 USDT from the broker to finance your trade.

If the price of XRP rises, you will make a profit. However, if the price of XRP falls by more than 10%, your position will be liquidated. This means that the broker will close your position and sell the 100 XRP. The proceeds from the sale will be used to repay the margin loan.

Benefits of Using Isolated Leverage

- Limit your losses to a specific amount

- Take on a lot of risk on a single trade.

- Reduce the risk of margin calls

Closing Your Trade:

Exiting a trade at the right time is crucial. To do so, you should consider the following factors:

- Price Movements: Observe how the price is behaving compared to your entry point.

- News and Events: Keep yourself informed about relevant news events that may have an impact on your trade. To execute an exit, go to the Positions tab located at the bottom of the Bitflex page, find your open position, and click on Market Close or Limit Close.

- Adjusting Stop-Loss and Take-Profit: You can adjust your stop-loss or take-profit levels by clicking TP/SL at the bottom of the page and modifying it according to your trading strategy.

Conclusion:

When it comes to crypto leverage trading, a careful and methodical approach is crucial. Traders need to evaluate their risk tolerance, stay alert to market fluctuations, and select the right leverage levels. It is important to use a variety of order types, such as market, limit, and conditional orders.

This requires thorough research and adaptability. Isolated leverage can be useful to limit losses and hedge positions, but traders must be mindful of the risks of liquidation.

In addition, it is essential to make timely exits based on price movements, informed by relevant news, and facilitated by stop-loss and take-profit levels. By combining knowledge, strategic planning, and flexibility, traders can confidently navigate Bitflex’s platform, ensuring a secure and profitable trading experience.

More Reading? Check Out These Articles:

- Bitflex Review: Crypto Leverage Trading With No KYC in 2023

- 5 Steps To Finding The Crypto Investment Style That Suits You. Beginners Guide

- A Beginners Guide to Crypto Leverage Trading