Over the last few years, we have seen the global adoption of cryptocurrencies sky rocket to the moon! This massive growth created one of the hottest markets you could have been in.

Cryptocurrencies were so volatile that every other day, someone was either making a million dollars or losing it in the market (many called it the wild west of investing). And as the news of the many riches being created spread, we saw a massive inflow of crypto investors, developers, and true believers into the crypto industry.

Now, the crypto market is a bit calm, but we expect to see the volatility pick up again in the future. The question now is “where will you be when the crypto bull run begins again?”

If you are a crypto investor looking to learn and sharpen your skills before this crypto bull run starts, this guide is the best way to go. We will be breaking down the 6 Popular Crypto Investment Strategies in 2023 and How To Use Them to better time the market and understand how to take advantage of these price moves.

But before we go into the investment strategies, you need to first understand what crypto is and how it works.

What Is Cryptocurrencies?

The word “crypto” is derived from the encryption techniques used to secure online communication during world war 2. Over the years, we have seen this technology advance and get incorporated into our security, banking system, communication, and more.

Well cryptocurrencies work in a similar version. They are digital currencies that run and operate through computer networks distributed across the globe. This computer network is called the Blockchain network and it hosts a public ledger that records every transaction that has ever been made on the blockchain network.

So when you invest in cryptocurrencies, you are not getting any physical item, instead your are getting a digital currency that has been encrypted in a way to allow you full access to store and manage your asset as you wish in either your online or offline wallets.

Check out this article: What Is The Blockchain Network and How Does It Work?

How Do Cryptocurrencies Get Their Value?

Well, now that you understand what a Cryptocurrency is, the next question you might be asking is

Since Cryptocurrencies are just encrypted codes that are sent from one user to the other on the Blockchain network, how does it get its value and why should I invest in it?

Well, that is a great question to ask because cryptocurrencies on its own are worthless and have no true-intrinsic value!

Back in the days, crypto coins were used only as gaming coins that had no effects on the real world. But as the years has gone by and more of our businesses and everyday lives have moved online, we needed a fast, secured digital way to transact with each other.

This new digital transaction way had to solve most of the limitations the present fiat banking system created for the new online community. And in comes cryptocurrencies.

So when it comes to determining the value of a cryptocurrency, you need to first understand:

- The project: The problem that crypto coin was created to solve

- The community: The amount of people interested in seeing this problem solved

- The utility: In what type of industries will this crypto coin be used in.

Check out this article: The 5 Types Of Cryptocurrencies We Have and How To Understand Their Utilities.

How Do You Invest In Cryptocurrencies?

Investing in the cryptocurrency market is just like investing in any other traditional market. You will most likely follow most of the same rules when it comes to finding what you want to invest in.

You do your research, calculate your risk, calculate how long you are willing to stay invested, and then have a backup plan that paints a clear picture of why you might want to exit this investment earlier than planned. 7 Things To Consider When Building A Crypto Investment Portfolio.

Once you understand what you want to invest in, how you want to invest in it, and for how long you are willing to stay in that investment, the rest just requires a click of a button to make it possible.

- You can decide to invest directly in the crypto market by purchasing a single crypto coin

- For limited exposure you can invest in U.S stock companies that have crypto exposure or in crypto exchange-traded funds (ETF).

- If you are more aggressive you can go into Leverage Trading and make use of crypto futures contracts.

No matter which way you choose to invest, the goal for you is to find the appropriate strategy that suits and works well with your crypto investment style.

Check out this article: A Beginners Guide to Crypto Leverage Trading

6 Popular Crypto Investment Strategies in 2023 and How To Use Them

1. Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a time tested investment strategy that works in almost every kind of market you can think of. This strategy is also the easiest to implement as a beginner trader, all you need is your consistency to make it work.

How does it work? Well this strategy involves you making small but consistent investments into your selected crypto coins. This consistent investment could include making a small crypto purchase every week, month, or even year no matter what the market condition is.

And the idea behind this strategy is that cryptocurrencies still have a massive upside potential in the coming years.

We do not know when this bullish rally to the upside will start. However, by making small but consistent investments into this market, we avoid timing the market but instead better position our investments in a way that it would benefit from the crypto bull run when ever it begins.

Benefits Of Using DCA Investment Strategies

- Requires little to no knowledge about Technical Analysis

- It is tried, tested, and used by a lot of investors from various markets.

- It remove’s FOMO by providing a clear structure for your investment strategy

- Crypto daily volatility does not matter or affect your investment negatively

- This is the best way to HODL any project you truly believe in

Check out this article: Top 5 Crypto Exchanges You Can Buy Bitcoin From

2. Crypto Staking

Crypto staking is another unique way of investing in the crypto market. Staking means that you are holding onto specific crypto coins that payout a reward. These rewards are paid out to investors who store their coins locked up in the network for a period of time.

These locked up funds are used to validate transactions and support the coin network, making it more reliable and leading to more growth.

With crypto staking, you can earn passive income simply by storing your coins. These types investments are not risk free, you still have the possibility of seeing the coin you are staking in fail and collapse. This makes research very important.

Note: Not all cryptocurrencies support staking.

Benefits of Using Crypto Staking Strategies

- It is really easy to implement for a beginner

- You can use it as a form of passive income

- Except from the possibility of project going burst, crypto staking is a less riskier investment strategy.

Check out this article: Beginners Guide: All You Need To know About Crypto Staking

3. Yield Farming and NFTs

Yield Farming works more or less like crypto staking does. You store up your crypto assets for a period of time and get rewarded for it. The only difference with Yield farming is the complexity of the crypto assets you can invest in.

With Yield Farming, you are required to combine strategies like Staking with more complex ones like DeFi liquidity pools investing, token minting, NFTs trading and more.

Yield farming requires a bit more knowledge about the crypto market, especially on the DeFi section of the industry. This DeFi section is still growing and therefore carries more risks to invest in.

Benefits of Using Yield Farming Strategies

- It allows you become a bit more aggressive with your investment style

- Yield Farming opens you up to DeFi (decentralized finance) a growing industry

- It can be used to generate passive income.

Check out this article: DeFi Investing For Beginners. All you need to know to get started

4. Value Investor/Early Adopter

When it comes to Value investing in the crypto market, you are required to have a bit more in-depth knowledge of the market and the various crypto projects that are going on in order to take advantage of any potential investment..

This is why Value investing is recommended for experts who know what to look for as an early adopter of any crypto project.

How does value investing work? Well, value investing requires you to research and find the undervalued coins/crypto projects/tokens, invest in them and wait for the market to finally take notice.

To be a value investor, you need to know what criteria’s to watch out for when doing your research and how various events in the markets can affect the outcome.

Benefits of Using Value Investing Strategies

- Buy low and selling high can offer you massive rewards on your investments

- You are always in-tune with the market

- You always catch a new trend early

5. Crypto Balanced Portfolio

Another popular crypto strategy used by professional investors is the Crypto Balanced Portfolio. This investment strategy requires you to diversify your investment risk across multiple crypto assets and even investment strategies.

This type of investing style offers crypto investors a way to reduce their drawdowns and hedge their risk even in a bearish market by taking advantage of different market sections.

But in order to pull it off, you will need to have a lot of knowledge about picking the right coins, understanding correlation, and following market cycles. With a Balanced portfolio, you will also need to rebalance periodically to tackle any change in the market trend.

Benefits of Using A Crypto Balanced Portfolio Strategy

- Helps you stay in-tuned with the Market cycle

- Reduces your investment drawdown and equity volatility even in bearish markets

- Requires constant research and rebalancing to make it agile for any market condition

Check out this article: Beginners Guide: How To Create A Balanced Crypto Portfolio For Any Kind Of Market Condition.

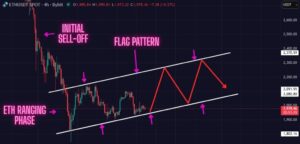

6. Technical Analysis

Becoming a crypto technical trader requires a lot of learning and interest in really understanding how the crypto price chart moves. if you have the time and resources to put into learning a crypto trading strategy, it would benefit you greatly.

With the skills of technical analysis, you can easily become more aggressive in the management of your crypto investments and portfolio. You can choose to become

- A scalper

- Day trader or

- A Swing trader

Each or these trading style requires unique set of skills in order to succeed with it.

Benefits of Using a Technical Analysis Strategy

- Technical analysis allows manage your investment more precisely to suit your risk appetite

- It is an aggressive way of growing your crypto investment

- The learning curve to become a profitable Technical Analyst pushes you to gain in-depth knowledge about the crypto market.

Check out this article: Beginners Guide: How To Buy Bitcoin

Conclusion

Crypto investing is a thriving and growing industry that will only get bigger as the years go by. There are now over 8,000 cryptocurrencies you can choose to invest from, and countless tokens and NFT projects coming out everyday.

Finding the right crypto assets to invest in portfolio requires you carefully considering a strategy to use. This strategy should paint a picture of what you should do and when.

If you have a strategy that gives you a clear instruction of when to buy and when to sell, you can easily begin to implement this strategy in the market.

A failure to have a strategy like this will only lead to you panicking or loosing focus when volatility gets pushed into the market. This why this 6 Popular Crypto Investment Strategies in 2023 and How To Use Them article is a must reader for any one looking to take crypto investing serious

Check out this article: Can You Get Rich Investing In Cryptocurrency?